The 2021 China Carbon Pricing Survey Report was launched in Beijing on 22nd February 2022, hosted by UNDP China. The survey elicited expectations about the future of China’s carbon price from stakeholders in carbon markets in China during November 2021 following the official launch of China's carbon market in July 2021. Through cooperation with industrial associations and key emitting enterprises, the project team reached a wide range of representatives from China’s carbon-intensive industries which are already subject to or are soon expected to be subject to carbon pricing, in particular the power generation sector which is the first to be covered by China’s national emissions trading system (ETS).

The survey received 417 responses from stakeholders in a range of sectors. 76% identified as being from carbon emitting enterprises, including 49% from companies already covered by either a regional carbon market or the national one. Of the emitting enterprises, the highest representation is from the power generation sector (33% of all respondents), followed by the building materials including cement (20%), steel (7%), chemicals (6%) and non-ferrous metals (5%) sectors. 10% of respondents are from companies providing carbon market-related services, including consultancy, verification, offset development and trading, while 3% came from research institutes. Other responses came from academia, the financial industry and local government.

The key findings of the survey:

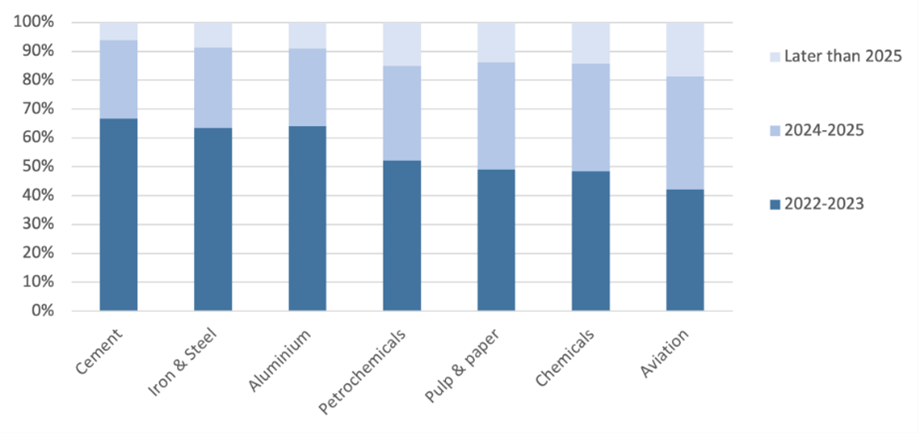

Which other sectors do you think will be ready to join the national system? (n=392)

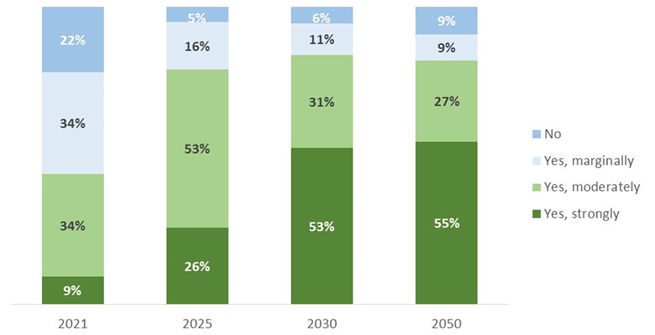

Do you expect the ETS in China to affect investment decisions in 2020, 2025, 2030, 2050? (n=390, 390, 377, 347)

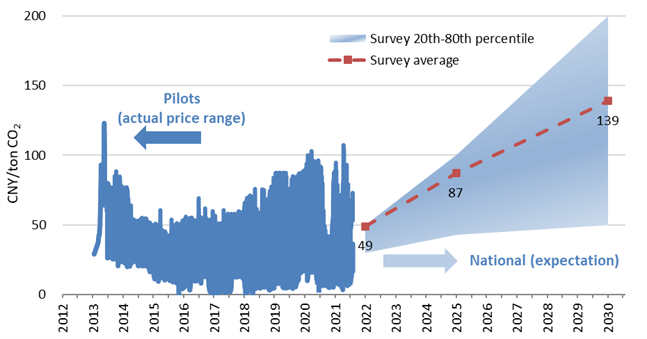

Range of prices in the regional systems to-date, and estimated prices for the national system

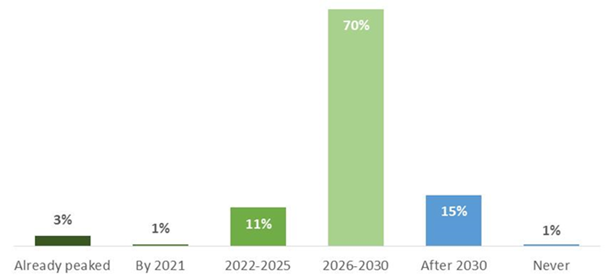

When do you expect China's emissions will peak? (n=399)

The survey also comes at a time of global interest in China’s actions on climate change. In September 2021, at the UN General Assembly, China’s President Xi Jinping announced that China would stop building new coal power plants abroad. Then, at COP26 in Glasgow in November 2021, China and the US released a Joint Glasgow Declaration on Enhancing Climate Action in the 2020s. While China was generally seen as playing a constructive role at COP26, there is increasing attention being paid to China’s domestic efforts to reduce reliance on coal. Corresponding to the key findings of the survey, most analysis of long-term pathways see carbon pricing playing a key role in these efforts.